Few lifestyle destinations are opening with a fitness centre of some sort within the mix and little wonder. A 4% increase in the number of people having health club memberships helped European fitness club operators record total revenues of €26.6bn during 2017 according to the most recent research in the European Health & Fitness Market Report 2018, published by EuropeActive and Deloitte last year.

The report also showed that the number of fitness facilities in Europe increased by 3.2% during 2017, to 59,055. The largest 30 European fitness club operators accounted for 14.1 million members, representing 23.5% of all memberships. Germany strengthened its position as the country with the highest number of fitness memberships (10.6 million), ahead of the UK (9.7 million), France (5.7 million), Italy (5.3 million) and Spain (5.2 million). In terms of market penetration, Sweden ranks highest with 21.4% of the total population holding a health or fitness club membership. Other countries with high fitness club penetration include Norway (20.9%), Denmark (18.3%), the Netherlands (17.0%), and the UK (14.8%). Overall, 7.6% of the total population in Europe were members of a health or fitness club, with a penetration rate of 9.1% for people aged 15 years and older.

Not surprisingly, athleisure has been a strong retail sector and among the recent success stories has been LuluLemon, which combines retail, F&B and exercise spaces within many of its stores and The Gap Corp looking to expand its Athleta retail brand.

LuluLemon is spearheading the booming athleisure market

LuluLemon is on target to become achieve $1bn in menswear sales along by 2023 and is trialling a subscription model for its loyalist customers as it looks to capitalise on an almost cult-like following among its devotees. The company has long fostered a sense of community with free yoga classes, running clubs and other events. It also supports ‘ambassadors’—athletes and yogis featured on its website—and organises races and festivals. CEO Calvin McDonald has vowed to take the connection with customers to a new level with the loyalty programme, which has been dubbed “Lululemon practice” for now.

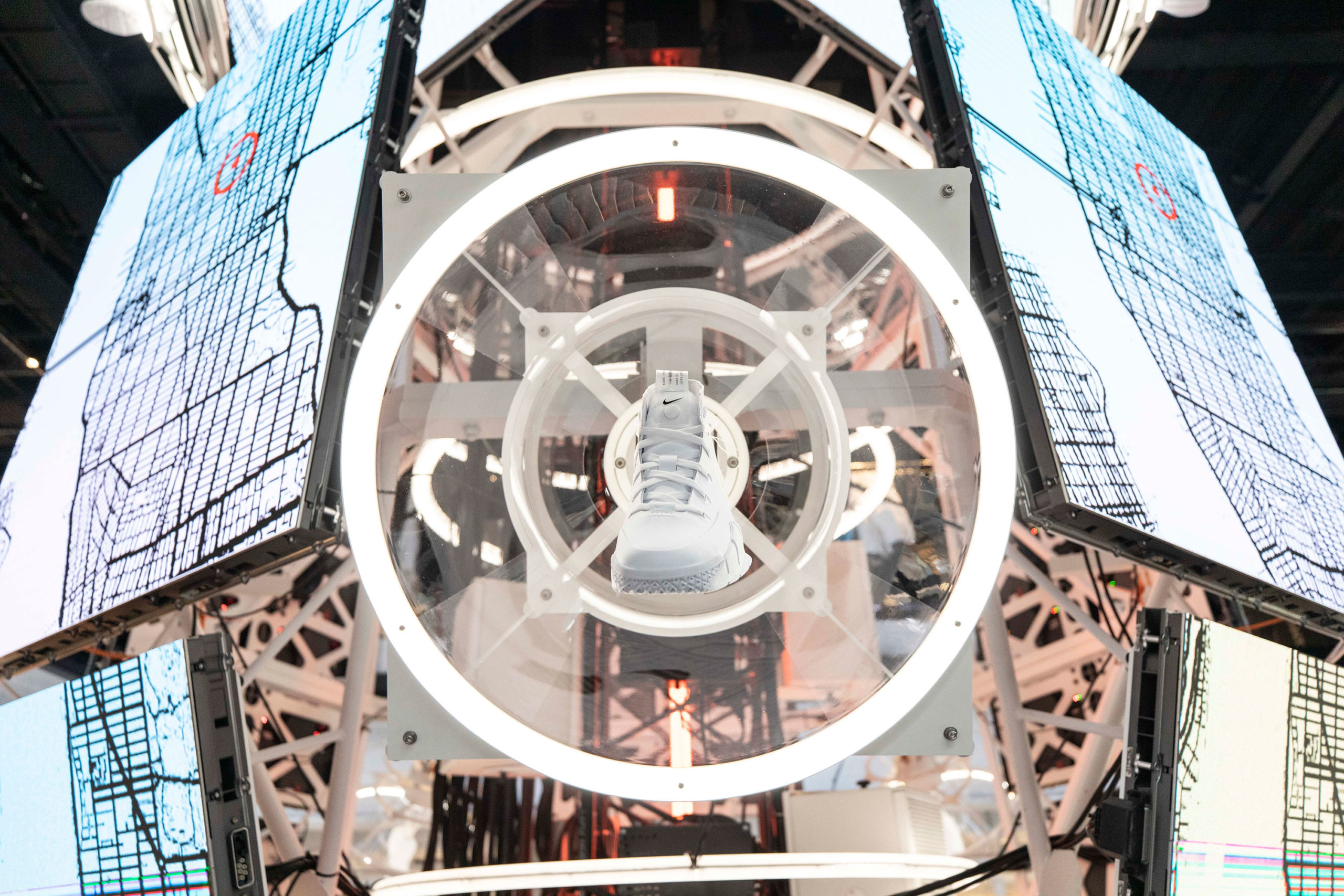

New-York : Nike has opened a new flagship in Manhattan

Meanwhile Nike has been testing a number of different formats, notably its new flagship store in New York, plus the Jumpman basketball concept in Los Angeles and Nike by Melrose in one of LA’s hottest neighbourhoods.