Choosing the Right Partnership

There will be a post COVID-19 time, and we all hope this will come sooner rather than later. During the lockdown many mall developers and operators have been working hard towards re-opening but also have continued to plan ahead, reflecting how the leisure industry has changed.

A first step in the introduction of any leisure and entertainment development within a retail environment should be to identify the key attractions and leisure activities best suited to the market and the developer’s goals and then understand potential attendance, financial viability, space requirements and the potential positive impact of the leisure in retail – all of which would be addressed by a comprehensive feasibility study.

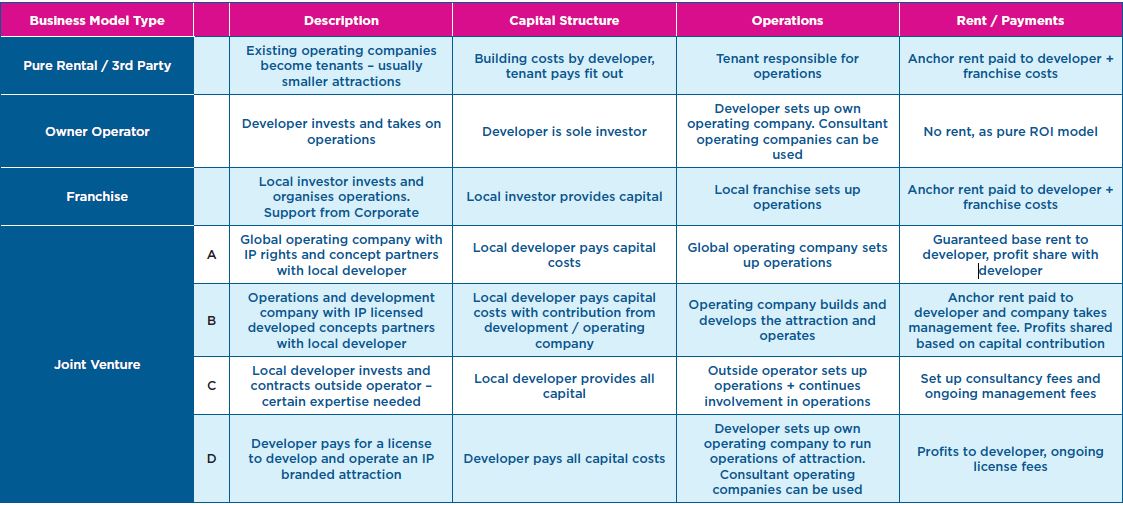

Assuming a positive outcome, the next step would be to reach out to potential partners and identify the right business model for your own business and the leisure partner. Unlike the retail market where the developer/owner and tenant relationship is typically well defined, across the attractions sector it is often more complex. There is no single attraction business model that can be applied to all attraction types. In fact, the more impact expected from the potential attraction, the more likely it is to be a partnership structure versus a pure tenant.

Mixed use retail and leisure: What happens next? – White Paper

In most cases a mall owner/developer will need to make some capital contribution, even if it is only building the shell and core for the attraction. The outside partner might take on all the attraction capital costs; however, they would typically pay a very low peppercorn rent. In other cases, the partner may not invest but may take on a management role for a fee, leaving the developer or another investor to enjoy any return. Again, some groups may vary their model by market and by negotiation. In the figure below we summarise some of the models that could be employed. As seen, there are myriad options that can be implemented.

In addition to the models shown, reflecting how the leisure industry has changed, there may be unique attractions that need a certain degree of operational expertise as well as a bespoke building in which case the outside partner will build and operating everything, takes all the profit and owns the building, and only pays a ground rent.

The type of model selected will be a function of a number of variables such as:

- goals of the developer/owner and why they are adding entertainment to the mix

- interest in the mall owner/developer in operating a facility or outsourcing it

- the type of entertainment or attraction being considered

- riskiness of the venture given local market conditions

- the forecast throughput and financial performance

- the skills required to conceive, deliver and operate

- the potential tenant and image impact for the wider development

- the appetite of the developer to step out of their comfort zone

- and others

All of these should be considered carefully when selecting the direction of the partnership structure.

Why Entertainment?

Entertainment is an ever-more important component of the retail and mall experience. LDP believes the general leisure market trends mentioned earlier in regards to the decline in demand for physical retail, coupled with the fusion of leisure and retail will not just continue, but will be accelerated by the pandemic, increasing the importance of leisure within the mall mix. A well thought entertainment strategy, coupled with the F&B offer and retail, can transform a more typical retail centre into a ‘lifestyle destination’, which can draw from further afield and achieve a higher frequency of visitation.

Measuring the benefits of entertainment in a retail environment is not as straightforward as looking at the typical retail metrics such sales densities and rents. Attractions should be treated as anchors, be it in a mall or any other retail setting. Retail investors and developers should aim to understand the impacts holistically and what leisure brings to the overall performance of the development not just the performance of the use itself.

The diagram below shows some of the reasons for including leisure in a planned or existing retail environment. Many of the impacts – such as extending catchments beyond the typical shopping centre drive time, increasing new and repeat footfall, evening-out visitor patterns across the week (for example, with school groups), and even positively impacting other tenants such as food & beverage tenants and the overall impact on retail spend – can be estimated beforehand through the feasibility process.

Some of the less tangible impacts, such as being able to differentiate a centre and improve the overall experience, are perhaps less easy to measure before opening (although can be imagined and used in early marketing campaigns) although intercept surveys once attractions are open will give good insights in these areas and can help shape the further development of leisure.

Final points to consider:

- As the demand for physical retail decreases, leisure and attractions offer a solution to strengthen the overall appeal of any development.

- Leisure may not reap the straight returns as retail on a sq m basis but it can help differentiate a development and appeal to multiple markets beyond the typical ‘shopper profile’ and catchment area of a retail mall.

- It is important that we don’t just think about ‘filling space’. Although leisure can be a solid substitute in some cases, it is important that the concept chosen is adding value to the overall drawing power of the development. Having a leisure, dining, entertainment and hospitality concept and strategy that is thought through for the entire mall or mixed use schemed is vital.

- There are numerous ways in which leisure attractions can add value to a development as discussed above

- Leisure and attraction concepts should be viewed as partners and not just simple tenants.

Written by Yael Coifman, senior partner, and James Kennard, partner, LDP.

For more, read on the future of retail in an interview of Joanna Fisher, CEO, ECE Marketplaces, get an overview of the year in numbers in the retail industry and get the whitepaper of covid impact on leisure and attractions.